WHO SHOULD HAVE AN OFFSHORE TRUST

People who have worked hard for their financial rewards, and who want to keep their assets secret and out of

reach of lawyers and lawsuits or seizure by government agencies:

- Anyone paying high premiums for liability insurance

- Anyone with a high net worth

- Anyone facing a costly divorce

- Anyone who is the potential target of a lawsuit

- Artists, inventors, and holders of copyrights, patents, or trademarks

- Professionals and small business owners

- Individuals who need to keep their financial affairs private

- Professionals working abroad

- Companies selling products abroad

THE COOK ISLANDS

TAKE STEPS TO LOWER YOUR TAXES

Courts have ruled time

and again that people can plan their affairs so as to pay the minimum amount of tax possible and the taxpayer

may use any legal means to do so. Americans ventured into the world of offshore a bit late in the game, nearly

forty years after the rest of the world had capitalized on the financial advantages of moving assets offshore.

The fact is that it is still both legal and quite simple for U.S. citizens to shelter their wealth offshore and

to accumulate tax-deferred profits.

Courts have ruled time

and again that people can plan their affairs so as to pay the minimum amount of tax possible and the taxpayer

may use any legal means to do so. Americans ventured into the world of offshore a bit late in the game, nearly

forty years after the rest of the world had capitalized on the financial advantages of moving assets offshore.

The fact is that it is still both legal and quite simple for U.S. citizens to shelter their wealth offshore and

to accumulate tax-deferred profits. Our accounting firm can handle your complete tax filing requirements and we will file the appropriate IRS forms with the Internal Revenue Service to make sure that you have reported all of your income abroad as is required of every U.S. citizen and U.S. corporate taxpayer.

The best way to protect your assets is not to own any...only if you own an asset is it vulnerable to attack.

|

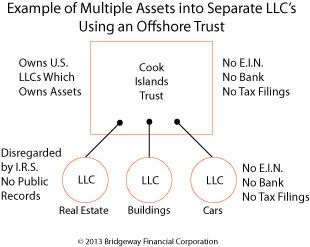

Cook Islands Asset PRotection Trusts

One of the practical and flexible solutions given by Cook Islands trust law is the ability to include provisions allowing a trust to retain shares in underlying companies, without concern as to the financial benefits of holding such shares. Similarly a trust may include provision negating the trustee's responsibility to monitor and intervene in the affairs of an underlying company. These features allow a trust to hold family businesses, or other investment companies, that clients amy want to retain for generations to come. Or which are intended to hold risky or speculative investments. The Trustee is not required to become involved in the decision making or management of the companies, which role can be left to the family members and trusted management.

Also of interest to many clients not used to dealing with an offshore trustee company, is the ability to utilize a private trustee company in the Cook Islands. In this structure the client, and/or advisors, are the shareholders and directors of a Cook Islands company which acts as the trustee of their Cook Islands Trust. The client gains the comfort of being his own trustee of their Cook Islands Trust. The client gains the comfort of being his own trustee, the flexibility of management of the trust, and yet still retains the benefits of Cook Islands trust law.

What are the unique features of Cook Islands' trusts?

- Foreign judgments are unenforceable against a Cook Islands International Trust if that judgment is inconsistent with Cook Islands law.

- Specific provisions ensure a trust is not defeated by rules relating to heirship or spendthrift beneficiaries in the jurisdiction of the settlor.

- A settler of a trust is able to retain control over the trust and its property if desired.

- Foreign bankruptcy rules are specifically excluded.

- A specific limitation period of two years exists for the bringing of proceedings by creditors seeking to access trust assets.

|

CONCLUSION

Many asset protection experts agree that an offshore trust in the properly selected jurisdiction is the strongest asset protection vehicle worldwide. The Cook Islands Trust has been shown to offer the strongest asset protection case law history. When a local court demands payment, the trust company in the Cook Islands, located outside your local court's jurisdiction, is not obligated to comply with the court order. Thus, the licensed, bonded, insured 30+ year old trust company keeps your assets out of harm's way. For client peace-of-mind we establish an offshore limited liability company (LLC) that is 100% owned by the trust. The client is the manager of the LLC. The accounts are held in the LLC in a very safe international bank. The client is the signatory on all bank accounts. Assets are not subject to seizure by the courts and the trustee can step in as the manager of the LLC and do what you have paid the trust company to do - protect your assets. Once the legal threat passes, the client is restored as manager of the LLC with the assets still intact. The Cook Islands trust has protected client assets from every legal challenge.

STOP BEING A TARGET FOR

MONEY-HUNGRY LAWYERS

A COOK ISLANDS TRUST IS THE ONLY CHOICE FOR MAXIMUM PROTECTION

A GROWING FORM OF ASSET PROTECTION

- Entities established within the offshore jurisdiction are exempt from any form of taxation in the Cook Islands including stamp duty, capital gains tax and capital duty

- Strong confidentiality provisions apply in the offshore regime, requiring government officials as well as trustee company and bank employees to observe strict secrecy. These provisions are backed by penal sanctions. The statutory records of the Registrar of International & Foreign Companies and of the Registrar of International Trusts are not open for general search, subject to the provisions of the Financial Transactions Reporting Act 2004, the Proceeds of Crimes Act 2003, and the Mutual Assistance in Criminal Matters Act 2003.

- The Cook Islands is highly regarded for its "Asset Protection Trusts" legislation, which has since inception been adopted by other offshore centers. The Cook Islands boasts a strong judicial precedent, which supports its asset protection legislation.

- An international trust has no taxation liability in the Cook Islands and no requirement to file any returns, reports, or records.

- An international trust allows the Settlor to retain or acquire; a power of revocation of the Trust; a power of disposition over Trust property; a power to amend the Trust Deed; and to retain an interest in the Trust property.4rust Deed; and to retain an interest in the Trust property.

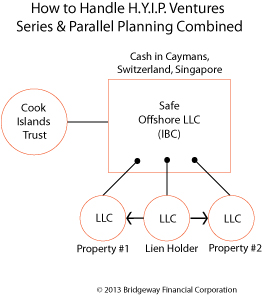

The New York Broker

Paul Winters was a successful investment banker in Manhattan. He quickly built up a large personal investment account but was worried over government interference and employment litigation due to some of his highly speculative decisions. Anything could go wrong.

He formed a Nevada Corporation, transferred his funds to Nevada, and then formed an International Business Company (IBC) and opened up brokerage and bank accounts in the Cayman Islands. He still had use of the funds and his IBC could easily make the same investments in the United States but now nothing was in his name. In addition, he transferred and re-titled all of his existing bank and brokerage accounts in New York into his offshore corporation. This allowed him the comfort of leaving funds in the United States while still having the ability to transfer his funds at a moments notice to 'safer waters.'

|

WHAT IF YOU ARE FACED WITH A LAWSUIT

Do not be fooled - even if you are innocent, that does not mean the courts are on your side. Jurors often side

with the plaintiff who appears to need the funds in question rather than the defendant who they assume has money

to spare.

Do not be fooled - even if you are innocent, that does not mean the courts are on your side. Jurors often side

with the plaintiff who appears to need the funds in question rather than the defendant who they assume has money

to spare.

Even a judge's own personal feelings or politics can put you in jeopardy. Read the following outrageous quote below:

"As long as I am allowed to redistribute wealth from out-of-state companies to injured in-state

plaintiffs, I shall continue to do so. Not only is my sleep enhanced when I give someone else's

money away, but so is my job security, because in-state plaintiffs, their families, and their

friends will re-elect me."

- Chief Justice Richard Neely, West Virginia Supreme Court

If you act NOW it's not too late to shield your assets from plaintiffs and their attorneys. Clients are happy

to learn that there is still a lot they can do to protect their assets.

JUDGMENT-PROOF YOUR ASSETS TO AVOID RUINOUS LAWSUITS

By forming a Cook Islands

Trust you create a legal entity to hold assets, do business and shelter the identity of the beneficial

owners. None of the investigative agencies which help trial lawyers, ex-spouses, ex-business partners and

creditors locate the wealth of the defendants they want to sue will be able to find your sheltered accounts

and assets. This makes you a poor prospect for a lawsuit.

By forming a Cook Islands

Trust you create a legal entity to hold assets, do business and shelter the identity of the beneficial

owners. None of the investigative agencies which help trial lawyers, ex-spouses, ex-business partners and

creditors locate the wealth of the defendants they want to sue will be able to find your sheltered accounts

and assets. This makes you a poor prospect for a lawsuit.

WITHOUT ASSET PROTECTION YOU COULD LOSE EVERYTHING

- Nine out of ten lawsuits in the world are filed in the United States

- If you own a business or practice a profession you have a one chance in three of being named a Defendant in a lawsuit in the next year, and it will only get worse. It is estimated that there are over 100,000 law school students in school right now.

The strongest asset protection for which the trust provides is for cash held in a safe foreign bank account. The courts where you live have the ability to seize local real estate. Therefore, it is fine to place real estate inside of the LLC that is owned by the trust. Alternatively, you record a lien against property where the lien is payable to the LLC inside of the trust.

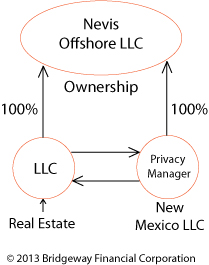

advanced planning

Complete privacy with flow through. A disregarded income and no tax returns required when offshore LLC, real

estate and New Mexico LLC's are owned by the following:

- Nevada LLC

- Nevada Corporation

- Nevada LLLP with Trusts

- Endowment Foundation (501(c)(3))

- Self-Directed IRA

Asset Protection from Lawsuits, Wealth Preservation, Debt Elimination, Business Entity Formation, Financial Strategy Consulting, Tax Reduction Consulting are based on sound principles of law, prudent forward planning, and compliance with the Internal Revenue Code. Tax evasion is illegal. Per IRS Circular 230, nothing herein may be used by any taxpayer to avoid penalties under the Internal Revenue Code for noncompliance or to support the promotion of any particular federal tax transaction. Taxpayers should confer with a Certified Public Accountant as to federal tax matters and timely file any applicable IRS forms or tax returns.

Not an offer of securities. Not intended as individual legal, tax or financial advice.

DISCLAIMER: All information contained in this website is for education purposes only. John Ewing, and its agents and affiliates, cannot and will not render any legal, investment, financial or tax advice of any kind, unless said agent or affiliate is duly licensed by the applicable state and/or federal authority to give said advice. Bridgeway Financial Corporation has been dissolved with the Nevada Secretary of State and is no longer operational. Any reference or references to Bridgeway Financial Corporation in this website and or on any of these website pages, content is strictly for educational and informational purposes only, and does not imply in any way or in any form or in any manner the existance of Bridgeway Financial Coporation or that it is in operation or affliated with this website.

John Ewing is not a broker or agent for any particular investment, but we share information with our clients about changing market conditions and attractive investment opportunities as we become aware of them.