PROVEN SECRETS TO WEALTH

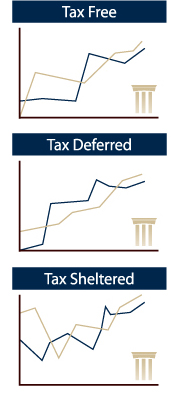

The richest American families have long combined three secret money making concepts to create their wealth -- Compounding Interest, Tax Deferral and investment in Real Estate among other savvy products. These secrets, when used with Charitable Trusts, Family Foundations and Private Banking Concepts have been the cornerstone for preserving the wealth of these family dynasties.

SELF-MANAGE YOUR MONEY

Working with special assets can enable a

knowledgeable investor to profit from their better understanding of the investment and its potential. Why pay someone

else to manage your retirement when you are capable of acquiring substantial retirement savings by investing in what you

know and understand?

Working with special assets can enable a

knowledgeable investor to profit from their better understanding of the investment and its potential. Why pay someone

else to manage your retirement when you are capable of acquiring substantial retirement savings by investing in what you

know and understand? TAKE STEPS TO LOWER YOUR TAXES

Our accounting firm can handle your complete tax filing requirements and we will file the appropriate IRS forms with the Internal Revenue Service to make sure that you have reported all of your income abroad as is required of every U.S. citizen and U.S. corporate taxpayer.

The best way to protect your assets is not to own any...only if you own an asset is it vulnerable to attack.

We Can PROVIDE EXCLUSIVE ACCESS

Our specialized expertise and

exclusive connections can now provide you with the same access to the world of the elite "Accredited Investor".

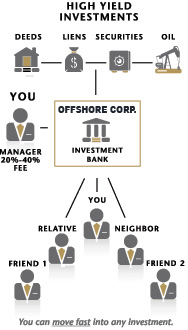

When you utilize a International Business Company (IBC) you can create your own "Investment Bank" where you,

not someone else, has full decision and control. You can use this Investment Bank concept just like Wall Street

professionals, and join with others to pool your investments.

Our specialized expertise and

exclusive connections can now provide you with the same access to the world of the elite "Accredited Investor".

When you utilize a International Business Company (IBC) you can create your own "Investment Bank" where you,

not someone else, has full decision and control. You can use this Investment Bank concept just like Wall Street

professionals, and join with others to pool your investments.YOUR OWN INVESTMENT BANK

For asset protection and tax reduction, you can use a Nevada Limited Liability Company (LLC) as the "Investment Bank" manager. Your Nevada LLC acts as “professional funds manager” for your "Investment Bank". Your Nevada LLC may earn 10% to 20% in Manager fees as the manager of the Nevis Offshore LLC. Additionally, you can participate in further profits by also being an investor.

You'll guarantee your complete financial privacy by using your Nevis Offshore LLC and Nevada LLC to protect yourself from lawyers and lawsuits. By doing so, you'll insulate your wealth from liability, confiscation and seizure.

FURTHER FREEDOM & SELF-DIRECTION

Independent-minded investors have been able to achieve substantial returns for years. From lease options to tax liens, knowledgeable investors holding special assets have flourished while the mainstream has had neither the vision nor the knowledge to participate.

A carefully designed corporate strategy allows you to legally reduce your tax burden while also avoiding legal and

taxation problems. Because a corporation has a life of its own, it allows you to care for your loved ones free from

probate court and its associated legal and tax costs and problems.

Simply put . . . you keep more of what you earn!

SELF-MANAGE YOUR MONEY

Working with special assets can enable

a knowledgeable investor to profit from their better understanding of the investment and its potential.

Working with special assets can enable

a knowledgeable investor to profit from their better understanding of the investment and its potential.TAX FREE INVESTMENTS

When you combine the magic of compound interest with tax free investments, you can powerfully accelerate the rapid growth of money

by investing with pre-tax dollars, instead of using after tax dollars.

INVESTMENTS

| Structured Settlements Real Estate Equipment Leasing Judgments Stocks, Bonds, Options Promissory Notes Viatical Settlements Sales Certificates |

Mobile Homes Factoring Receivables Deeds of Trust General Partnerships Mortgages Limited Partnerships Mutual Funds |

WALL STREET VERSUS YOU

WHY CAN'T I BE AN "ACCREDITED INVESTOR" ?

The Federal Securities Laws of 1933 (Securities) and 1934 (Exchanges) restrict and

place heavy encumbrances upon companies that wish to go public or raise funds and thus prevents many of the best

investment companies from ever offering their investments to anyone except a narrowly defined class of "Accredited

Investors". In short, to be an Accredited Investor you must have a net worth of at least 1 million dollars, or an

annual income exceeding $200,000 for two years. Less than 4% of Americans meet these narrow qualifications, by design.

However, now there is another option!

The Federal Securities Laws of 1933 (Securities) and 1934 (Exchanges) restrict and

place heavy encumbrances upon companies that wish to go public or raise funds and thus prevents many of the best

investment companies from ever offering their investments to anyone except a narrowly defined class of "Accredited

Investors". In short, to be an Accredited Investor you must have a net worth of at least 1 million dollars, or an

annual income exceeding $200,000 for two years. Less than 4% of Americans meet these narrow qualifications, by design.

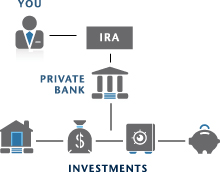

However, now there is another option! CREATE YOUR OWN "Private Bank" Strategies

The “Private Bank” concept consists of

attracting individuals with retirement savings, offering them attractive rates of returns, and utilizing these funds

to increase your output and profitability.

The “Private Bank” concept consists of

attracting individuals with retirement savings, offering them attractive rates of returns, and utilizing these funds

to increase your output and profitability.

Lending institutions, insurance companies, and venture capitalists have been using similar concepts for years.

By using self-directed IRAs you can utilize this concept which will allow you to become more profitable and stay

ahead of the competition.

Simply move funds from your existing IRA to a self-directed IRA. Then set up your LLC and move funds into this

Limited Liability Company.

You can move fast into any investment.

We PROVIDE THE FOLLOWING

1. Preparation and filing of the Memorandum of Association with the Registrar of Offshore Companies to create and incorporate the IBC.

2. Appointment and payment of a registered agent for one year for the IBC.

3. Appointment and payment of an Officer/Director to serve the IBC for one year.

4. Preparation of the initial Minutes, filing of the Notice of Registered Office, and issuance of Share Certificates.

5. An offshore account may be established.

6. Your IBC will be formed in three business days. To ensure complete anonymity, this can all be done over the telephone and payment may be made by credit card.

7. We can arrange for all wire transfers into and out of any offshore account to be completed with total anonymity..

DISCLAIMER: All information contained in this website is for education purposes only. John Ewing, and its agents and affiliates, cannot and will not render any legal, investment, financial or tax advice of any kind, unless said agent or affiliate is duly licensed by the applicable state and/or federal authority to give said advice.

PROHIBITED TRANSACTIONS: A prohibited transaction is any improper use of your IRA account by you, your beneficiary, or by any disqualified person. The following are prohibited transactions: Borrowing money from your IRA • Selling personal property to your IRA. • Receiving unreasonable compensation for managing your IRA investments • Using your IRA as a security for a loan • Purchasing property for personal use with IRA funds. • Purchasing collectibles with IRA funds • Purchasing assets owned by yourself, your spouse or other family members with IRA funds • Your business may not be located on the property owned by you.

NOT AN OFFER OF SECURITIES: Not intended as individual legal, tax or financial advice. We are not a broker or agent for any particular investment, but we share information with our clients about changing market conditions and attractive investment opportunities as we become aware of them.

SECURE YOUR FUTURE - PROTECT YOUR ASSETS - GO OFFSHORE !

jurisdictions offering such benefits. Offshore companies or offshore trusts are not the illicit hideaways from tax authorities as sometimes presented. When set up and managed correctly they provide asset protection in a perfectly legal manner. In simple terms, an International Business Corporation can provide excellent asset protection and privacy while at the same time provides a client with excellent access to International Investment Banking opportunities.

THE CAYMAN'S

The Offshore Protection Plan is everything you need to begin your new International Business Corporation (IBC) and operate legally with complete Asset Protection. Offshore Protection is quick and very affordable.

WANT TO MAKE YOUR FORTUNE GROW? CONSIDER OFFSHORE BANKING!

Offshore banks provide access to politically and economically stable offshore jurisdictions that may be of advantage for those living in areas where there is a risk of expropriation or where there is instability or corruption within the banking system. Many offshore banks offer services that may be unavailable in one's country of residence. The British Virgin and Cayman Islands, to name a few, prohibit the disclosure to any third-party of information pertaining to a client’s affairs without the client ’s explicit written permission under penalty of law. Some offshore banks may even provide higher interest rates than banks in the home country.

The majority of offshore banks operate within highly regulated environments under national monetary bodies such as Central Banks, Financial Services Commissions, etc. These banks are required to maintain capital adequacy requirements in accordance with international standards, and they must submit financial reports at least quarterly to the regulator on the current state of their business.

One common misconception about offshore banking and offshore accounts is that they can legally prevent assets from being subject to personal income tax or interest. This conception is usually not applicable because the personal income tax statutes of most countries makes no distinction between interest earned in local banks and those earned abroad. For instance, people subject to US income tax are required to declare any offshore bank earnings they may have.

An offshore bank account will allow you to safely and privately explore, with few restrictions, the far reaches of the vast and diverse financial universe; from the bond markets of Korea to the stock exchanges of Eastern Europe; from ultra-private Liechtenstein trust arrangements to the most successful funds; from unique commodity investments to Caribbean corporations; from Israeli nanotech start-ups to age-old European blue-chips; from the mysterious and secretive world of offshore mutual funds to tax-free Swiss gold accounts; from Isle of Man Insurance contracts to Danish multi-currency investment accounts; from uniquely structured tax-free Austrian funds to Bulgarian mortgages; and much more beyond.

WHO CAN BENEFIT FROM OFFSHORE BANKING?

Offshore banks provide access to politically and economically stable jurisdictions. This may be an advantage for those residents in areas where there is a risk of political or economic turmoil who fear their assets may be frozen, seized, or disappear - eg. during economic crisis, etc.

Some offshore banks may operate with a lower cost base and can provide higher interest rates than the rate in your home country due to lower overheads and a lack of government interference.

Interest is generally paid by offshore banks without tax deducted. This is an advantage to individuals who do not pay tax on worldwide income or who do not pay tax until a tax return is prepared.

Some offshore banks offer banking services that may not be available from domestic banks such as anonymous offshore bank accounts, numbered accounts, higher or lower rate loans based on risk and investment opportunities not available elsewhere.

Offshore banking is often linked to corporate structures such as offshore companies, offshore trusts or foundations which may have specific tax and asset protection advantages for some individuals.

Offshore finance is one of the few industries, along with tourism, that geographically remote island nations can competitively engage in. Offshore banking and finance can thus help developing countries to source investments and create growth in their economies. Offshore banking creates additional tax and banking competition and is an advantage to the industry as tax competition allows people to choose an appropriate balance of services and taxes.

USE AN OFFSHORE INTERNATIONAL COMPANY

Move funds from your existing IRA to a self-directed IRA.

Set up your IBC and then move funds into a Nevis

Limited Liability Company. You now have control to move funds into high yield investments tax free and

compound your earnings.

Insulate your wealth from liability, confiscation and seizure using a single member IBC directly owned by your

self-directed IRA account.

Using funds from your self-directed IRA and IBC combination, you can load up your tax free and deductible

investment year after year.

If you are buying offshore properties, you can qualify your next investment as a large down payment on real

estate. As you contribute to your IRA you are able to get tax deductions. You can bring down the mortgage by

doubling up your payments. Learn how the real estate professionals are doing it.

Guarantee your complete financial privacy by using your self-directed IRA and IBC in combination to protect you

from lawyers and lawsuits.

You can use a IBC as your investment company with the only member partner being your IRA. You become the “funds

manager”. Create your own “Private Bank” where you, not someone else, have decision control. Use this Private

Banking concept just like the professionals on Wall Street. Join with others and pool your investments.

Who should use an ibc?

- Anyone who is the potential target of a lawsuit

- Anyone concerned about The Patriot Act

Anyone with a high net worth

Anyone with a high net worth

- Anyone paying high premiums for liability insurance

- Professionals and business owners

- Individuals who need to keep their financial affairs private

- Anyone needing to separate high-risk investments from other assets

- Anyone wishing to buy bonds, securities, and mutual funds or precious metals not available to U.S. citizens

The ‘type’ of person who falls into the above three categories range from those with inherited wealth to those

who have earned it; all utilize offshore banking for the benefits of taxation planning, estate planning, privacy

and asset protection.

other advantages of ibcs

The first step in becoming judgment-proof is to get your assets out of your personal name.

One of the best ways to do this is to transfer your liquid assets into an offshore corporation. This is a legal

entity that you control. Lawyers for plaintiffs will only continue to pursue cases they believe wil pay off, not

those against judgment-proof defendants. The best way of getting the plaintiff's lawyer to accept a token

settlement is to convince the lawyer that you have no assets.

The first step in becoming judgment-proof is to get your assets out of your personal name.

One of the best ways to do this is to transfer your liquid assets into an offshore corporation. This is a legal

entity that you control. Lawyers for plaintiffs will only continue to pursue cases they believe wil pay off, not

those against judgment-proof defendants. The best way of getting the plaintiff's lawyer to accept a token

settlement is to convince the lawyer that you have no assets.

By forming an offshore international business company, you create a legal entity to hold liquid assets. And

no one knows who the owner is. All of the investgative agencies, which help trial lawyers, ex-spouses,

ex-business partners, and creditors locate the wealth of the defendants they want to sue, will not be able to

see or locate your offshore accounts. This makes you a poor prospect for a lawsuit.

- An IBC and its shareholders are exempted from the payment of offshore business license fees, income taxes, corporation taxes, capital gains taxes, or any other taxes on income or distribution in connection with any transaction to which the IBC or the shareholder is a party

- No estate, inheritance, succession, or profits tax is payable to any offshore haven with respect to its shares, debt obligations or other securities.

- The minimum number of subscribers and directors is one. Names of shareholders are not recorded in any public registry. No filing of financial statements or annual returns listing shareholders is required.

- Meetings of directors and shareholders may be held by telephone or fax or other electronic means.

- An IBC is not subject to any offshore currency exchange control regulations.

- Government registration and annual fees are low.

- No offshore tax returns are required of any kind.

- Any account may be held in any currency. Any account may be held in a money market fund.

- All offshore income can be reported discreetly with the use of a private Nevada Corporation.

OFFSHORE BANKING FAQ

Is it legal for me to have an offshore bank account?

Yes, absolutely legal. Offshore banking has been routinely and legally used for many years by individuals and

organizations worldwide. Because many countries encourage international trade and enterprise, there are usually

only limited restrictions on residents doing business or having bank accounts in other countries. However,

reporting requirements on these accounts differ from country to country.

Why should I bank offshore?

There are many reasons to bank offshore. Reasons include asset protection, estate planning, confidentiality,

better returns and the chance to exploit active business interests overseas from a zero tax jurisdiction with

near hermetic confidentiality.

Is it convenient to use offshore banks?

Yes. With Internet, e-mail, fax and telephone banking and the use of ATMs, your money is just as accessible as

it is from your local bank account. You can easily and quickly transfer your money around the world by

electronic transfer and can effectively bank wherever you are.

Asset Protection from Lawsuits, Wealth Preservation, Debt Elimination, Business Entity Formation, Financial Strategy Consulting, Tax Reduction Consulting are based on sound principles of law, prudent forward planning, and compliance with the Internal Revenue Code. Tax evasion is illegal. Per IRS Circular 230, nothing herein may be used by any taxpayer to avoid penalties under the Internal Revenue Code for noncompliance or to support the promotion of any particular federal tax transaction. Taxpayers should confer with a Certified Public Accountant as to federal tax matters and timely file any applicable IRS forms or tax returns.

Not an offer of securities. Not intended as individual legal, tax or financial advice.

DISCLAIMER: All information contained in this website is for education purposes only. John Ewing, and its agents and affiliates, cannot and will not render any legal, investment, financial or tax advice of any kind, unless said agent or affiliate is duly licensed by the applicable state and/or federal authority to give said advice. Bridgeway Financial Corporation has been dissolved with the Nevada Secretary of State and is no longer operational. Any reference or references to Bridgeway Financial Corporation in this website and or on any of these website pages, content is strictly for educational and informational purposes only, and does not imply in any way or in any form or in any manner the existance of Bridgeway Financial Coporation or that it is in operation or affliated with this website.

John Ewing is not a broker or agent for any particular investment, but we share information with our clients about changing market conditions and attractive investment opportunities as we become aware of them.