Family Living Trust Benefits

|

|

USing A FAMILY LIVING TRUST TO AVOID PROBATE COURT

Probate is the automatic legal process whereby a Court Judge administers your will, according to the law, and

adjudicates the interests of your heirs and other parties who may have claims against your estate. By law,

it is

necessary to "probate your estate", whether or not you have a valid will. Any party may challenge

the

probate in court and if the claim is rejected, the claimant may file a lawsuit to prove the claim.

Property held in a Living Trust avoids probate. Your

personal

representative provides documentation to the court, and your estate is prevented from ever entering probate.

One of the many ways to avoid probate is to execute a Living Trust.

Property held in a Living Trust avoids probate. Your

personal

representative provides documentation to the court, and your estate is prevented from ever entering probate.

One of the many ways to avoid probate is to execute a Living Trust.

As creator of a trust, you transfer ownership of your real property from yourself to a trust- which you

control

and can revise at any time. Upon death, the persons you named as beneficiaries in the trust acquire full

ownership of the property of the trust. A Living Trust helps your estate avoid estate tax. And unlike

probate

(which is a fully public process), a Living Trust shields your private affairs and that of your heirs from

public scrutiny.A Family Living Trust is a necessary component in family and estate planning.

A Family living Trust

Because of its unique regulatory and legal climate, Nevada has become the State of choice for forming Trusts. We offer Nevada residents and non- residents alike, access to Nevada based services, including trusts, custody and investment man- agement services, so they can take advantage of Nevada's liberal body of trust, corporate and tax law. Clients benefit from experienced administration, superior personal service and the ability to make important decisions quickly.

Once the Court gets involved it usually stays involved until you recover or die. The Court, not your

family, controls how your assets are to be used to care for you. Probate is expensive, embarrassing, time

consuming and difficult to end even if you recover. Since the process does not replace probate, your family

will

have to go through the Court system at least twice. A Family Living Trust prevents court

intervention.

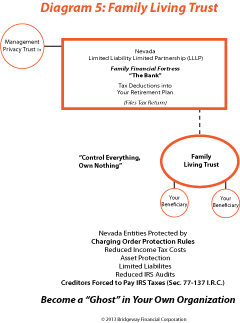

A Family Living Trust (FLT) completes your planning and is the capstone for all your personal needs. A Family Living Trust is a legal document drafted in conjunction with a Pour Over Will, a Living Will, Letter of Wishes, Durable Power of Attorney and Non-Contestability. Together with the Management Privacy Trust™ they will enable you to avoid probate and allow you, not the courts, to control your assets while you are living. If you become disabled or incapacitated, the Trust will appoint the person you have named to act as your guardian using the durable power of attorney you have authorized.

Asset Protection from Lawsuits, Wealth Preservation, Debt Elimination, Business Entity Formation, Financial Strategy Consulting, Tax Reduction Consulting are based on sound principles of law, prudent forward planning, and compliance with the Internal Revenue Code. Tax evasion is illegal. Per IRS Circular 230, nothing herein may be used by any taxpayer to avoid penalties under the Internal Revenue Code for noncompliance or to support the promotion of any particular federal tax transaction. Taxpayers should confer with a Certified Public Accountant as to federal tax matters and timely file any applicable IRS forms or tax returns.

Not an offer of securities. Not intended as individual legal, tax or financial advice.

DISCLAIMER: All information contained in this website is for education purposes only. John Ewing, and its agents and affiliates, cannot and will not render any legal, investment, financial or tax advice of any kind, unless said agent or affiliate is duly licensed by the applicable state and/or federal authority to give said advice. Bridgeway Financial Corporation has been dissolved with the Nevada Secretary of State and is no longer operational. Any reference or references to Bridgeway Financial Corporation in this website and or on any of these website pages, content is strictly for educational and informational purposes only, and does not imply in any way or in any form or in any manner the existance of Bridgeway Financial Coporation or that it is in operation or affliated with this website.

John Ewing is not a broker or agent for any particular investment, but we share information with our clients about changing market conditions and attractive investment opportunities as we become aware of them.