Case Story #1:

Safeguarding your business and building personal protection

The company is a successful North Carolina home builder. After several years, following many construction

defect lawsuits, they found that it was getting increasingly difficult to carry liability insurance for

themselves and their projects; coverage was just getting too expensive. Eventually, the owners made a

decision to stop carrying liability insurance coverage altogether. Without insurance coverage, the owners

realized that they were exposed to all forms of liability lawsuits. The only alternative was asset

protection for the company and themselves as the best alternative to insurance coverage.

First, the company's operations had to be restructured so that any liability arising from a building project

could not exceed the amount of the operating company's assets, if any. It was further decided that a

separate legal operating entity would be established for each construction project.

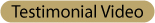

In addition, they created a separate Limited Liability Company (LLC) to own their company equipment and did a “tax free” lease-back to the operating company. They were able to accomplish this by having a CPA do a Section 355 tax-free spin-off.

In order to further insulate each project they had separate entities own the real estate and do the development work. Each entity was managed by a Nevada Corporation with special “gross negligence” provisions and special asset protection “enhancements” to protect them from creditors.

Finally, they created an additional layer of legal entities to further insulate themselves as owners from the liabilities of the business by protecting their home, personal property, real-estate, and investments.

Their first test came several months later and this protective structuring worked as planned. The plaintiffs, upon seeing the level of protection they were faced with, dropped what could have been a class-action lawsuit and accepted a surprisingly low settlement offer.

INCORPORATE EVEN IF YOU DON'T HAVE

A BUSINESS

There is a reason why almost all successful people choose to incorporate. It permits them to manage their assets anonymously and their private corporate lives are never made public. Only in Nevada can a corporation be set up so that you own and control your corporation while your identity and ownership remain a total secret. Some individuals choose to have a separate corporation for their large assets such as brokerage accounts, a rental property, a boat, or recreational vehicles.

Profit

Your corporation can maximize profits by taking advantage of the tax laws. A corporation can write off most

purchases of goods, vehicles, and services as expenses. By organizing your activities so that much of the

profits go to a corporation in tax-free Nevada, you can dramatically increase your net income. You pay the

government less—and take home more!

Flexibility

A corporate structure allows you to place different investments under separate corporations. You retain complete

control of all your investments. But if one corporation runs into trouble, it won’t suck the profits away from

the other, more successful, investments. Without incorporation your profitable ventures would have to pay the

debts of any unsuccessful ventures!

Estate Benefits

Because a corporation’s existence is perpetual, your corporation can outlive you. By using estate-planning

strategies that are possible only with a Nevada-based corporation, you may be able to pass your estate to your

heirs without going through probate. This can save both legal costs and inheritance taxes.

Protection

Nevada permits corporations to lien up homes, cars, boats and business assets.

Normal Corporations Offer No Protection

Jeff and Dave each own shares in a car dealership, with Jeff owning 60% of the stock and Dave owning 40%. They had been told by their accountant that doing business out of the corporation would give them a certain degree of asset protection. They were not advised of the advantages of a Nevada corporation or LLC.

Jeff’s wife was involved in a major automobile accident and the couple was targeted by plaintiff’s attorneys in a crushing lawsuit. Jeff's wife lost, and together the married couple were held to be responsible for the large judgment and subsequent debt. Jeff and his wife were informed of the judgment against them; nothing could now prevent the plaintiff from seizing Jeff’s stock in his company, making the plaintiff, and his attorney, the new controlling shareholders of the car dealership. Jeff lost all ownership and control of his company.

What could have been done differently? First, Jeff and Dave should have formed a Nevada Limited Liability Company (LLC) and then filed as a foreign entity in the state they were doing business in.

Next, instead of owning the shares of the dealership personally, Jeff and Dave should have each owned a Nevada corporation to own their shares and also thereby taken advantage of the individual tax planning, individual asset protection and tax-free dividends available to them.

Lastly, they could have formed a second LLC owned by their offshore company or have the assets owned by a Nevada LLC to own and protect assets and lease back those assets for protection and tax savings.

Nevada Corporations and Nevada LLCs are protected from the claims of creditors by charging order protections.

ASK YOURSELF...WHAT IS PEACE OF MIND REALLY WORTH TO YOU?

THE GREATEST PERSONAL LIABILITY PROTECTION

STOP BEING A TARGET FOR

MONEY-HUNGRY LAWYERS

ASSET AND LIABILITY PROTECTION

Because it is an independent entity, a Nevada company's debts and taxes are separate from those of its owners.

Therefore, Nevada provides an individual in business, whether salaried or on commission, with the greatest personal liability protection.

Nevada doesn't share confidential information about its corporations and limited partnerships with the IRS. In 1992 and again in 2001, the IRS formally requested such an exchange program and the Nevada Governor turned the IRS down flat!

Listen below to John Ewing's exclusive call about the Business Protection Plan:

WHO SHOULD HAVE a NEVADA TAX SAVING ENTITy

The obvious answer is anyone whose combined Business and Personal taxes are cutting deeply into their income. If you

look at the money that is going to the government and think, “I could do so much more with that than they will,”

you need a Nevada corporation.

Further, you can set up an LLC owned by your Nevada Corporation to separate your business assets from your operating

company to protect your equipment and other assets from customer liability and lease back your assets for

significant tax savings.

Nevada is the only state that provides "Charging Order Protection" for both corporations and LLCs. This

prevents personal creditors from seizing your corporate shares and thereby taking control. Nevada law clearly makes

the actions of a corporation’s representatives exempt from personal responsibility except in cases of outright

fraud. The best asset protection is to incorporate; the best place to incorporate is in tax-free Nevada.

WHAT IF YOU ARE FACED WITH A LAWSUIT

Do not be fooled - even if you are innocent, that does not mean the courts are on your side. Jurors often side with the

plaintiff who appears to need the funds in question rather than the defendant who they assume has money to spare.

Do not be fooled - even if you are innocent, that does not mean the courts are on your side. Jurors often side with the

plaintiff who appears to need the funds in question rather than the defendant who they assume has money to spare.

Even a judge's own personal feelings or politics can put you in jeopardy. Read the following outrageous quote below:

"As long as I am allowed to redistribute wealth from out-of-state companies to injured in-state

plaintiffs, I shall continue to do so. Not only is my sleep enhanced when I give someone else's money away,

but so is my job security, because in-state plaintiffs, their families, and their friends will re-elect me."

- Chief Justice Richard Neely, West Virginia Supreme Court

If you act NOW it's not too late to shield your assets from plaintiffs and their attorneys. Clients are happy to

learn that there is still a lot they can do to protect their assets.

Nevada is Tax Heaven

- No corporate income tax

- No capital stock tax

- No gross receipts tax

- No succession tax

- No tax on issuance of shares

- No inventory tax

- No estate tax

- No franchise tax

- No gift tax

- No personal, state, city, or income tax

- No minimum start-up capital required

- No stock sale or transfer tax

- No inheritance tax

- No annual reports necessary

- No need to list assets

Other Advantages

- Cut your audit risk

- 300+ tax deductions

- Nevada is the only state that prevents personal creditors from seizing shares and liquidating your assets

- One-person entities allowed

- No attachment of corporate shares by personal creditors

- No delay - entities can be formed in 24 hours

- Corporate meetings may be held anywhere

- Nevada Corporations and Limited Partnerships can own property in any state without having to be incorporated in that state

- Shareholders and Directors need not be residents (or U.S. citizens) and do not need to come to Nevada

- Nevada allows for section 355 Tax Free spin-off to move all or some corporate assets.

Asset Protection from Lawsuits, Wealth Preservation, Debt Elimination, Business Entity Formation, Financial Strategy Consulting, Tax Reduction Consulting are based on sound principles of law, prudent forward planning, and compliance with the Internal Revenue Code. Tax evasion is illegal. Per IRS Circular 230, nothing herein may be used by any taxpayer to avoid penalties under the Internal Revenue Code for noncompliance or to support the promotion of any particular federal tax transaction. Taxpayers should confer with a Certified Public Accountant as to federal tax matters and timely file any applicable IRS forms or tax returns.

Not an offer of securities. Not intended as individual legal, tax or financial advice.

DISCLAIMER: All information contained in this website is for education purposes only. Bridgeway Financial Corporation™, and its agents and affiliates, cannot and will not render any legal, investment, financial or tax advice of any kind, unless said agent or affiliate is duly licensed by the applicable state and/or federal authority to give said advice.

Bridgeway Financial Corporation is not a broker or agent for any particular investment, but we share information with our clients about changing market conditions and attractive investment opportunities as we become aware of them.