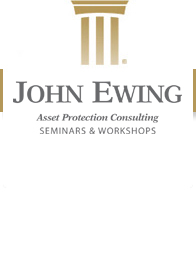

BRIDGEWAY ASSET PROTECTION PLAN™

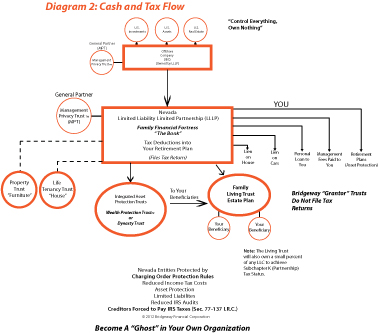

You become like the great and powerful Oz... you own nothing but control everything. Control assets without revealing your name, social security number, or ownership interest. As the "Banker" you can buy yourself a company car, give yourself a personal loan or perhaps mortgage up your own property to protect your equity. As the "Banker" of your private bank you can wire funds in and out of the country, set up corporations and LLC's owned by your Nevada LLLP (not you) and make investments. But probably the best part is you can give yourself a corporate benefit plan to wipe out taxes and/or pay yourself and your spouse managements wages.

You can open a bank or brokerage account without providing your social security number. Transfer funds, both in and out of the country, without ever revealing your identity and design an estate plan your creditors can't touch. And how you can o offshore to "bulletproof" your cash and learn the secrets for hiding and protecting your assets from lawsuits and seizures!

The following steps provide you with the best asset protection:

- STEP 1 - Form a Management Privacy Trust™ (MPT) to act as the general partner and nominee of LLLPs and LLCs to give you total privacy. This trust and your name do not appear on any public record thereby allowing you discreet control by directing the trustee.

- STEP 2 - Form a Wealth Protection Trust™ (WPT) that owns a Limited Liability Limited Partnership (LLLP) company as the asset protection foundation.

- STEP 3 - Next, form a Nevada Limited Liability Limited Partnership (The Triple LLLP) that owns the Offshore Company keeping you and your family in complete privacy and fully protected by Nevada's charging order protection and trustee nominee privacy rules.

- STEP 4 - Next, form the Offshore Company (IBC) and have your trustee wire your large "nest-egg" investment to an offshore bank beyond the reach of the U.S. court system.

- STEP 5 - Next, have your trustee form inexpensive domestic 'privacy' LLCs owned by the IBC that in turn re-titles the ownership name of your home, cars, boat, furniture, vacation property and the U.S. investments to these LLCs. Further, have the trustee create promissory liens on all your properties and your home using these same LLCs.

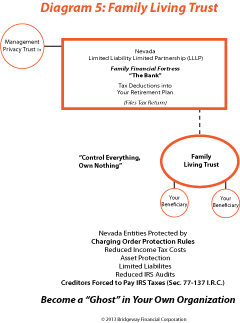

- STEP 6 - Finally, a Family Living Trust containing a Physician's Directive, Last Will & Testament, Guardianship, Durable Powers of Attorney, Non-Contestability, Letter of Wishes and Pour-Over Will provisions to secure the family's estate for your heirs.

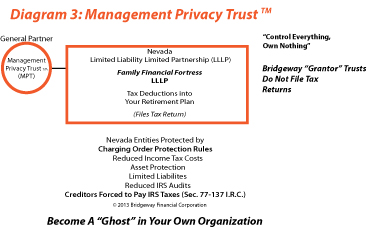

MANAGEMENT PRIVACY TRUST AND LLLP

Create privacy by using a Management Privacy Trust™ (“MPT”) and a Nevada Limited Liability Limited Partnership (LLLP) to pass your family business and real estate interests to your heirs as successor beneficiaries. Management Privacy Trusts can also be used to prevent your Family Limited Liability Limited Partnership from being used by your creditors to discover your most valuable assets.

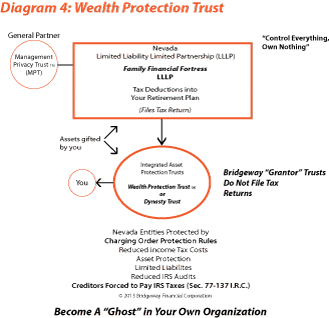

USING THE WEALTH PROTECTION TRUST ™

These trusts can hold a variety of assets for the beneficiaries in a safe manner and work best with other legal entities. The trustee can hold, administer,manage, and distribute the trust's assets to its beneficiaries without interference by the settler’s subsequent business or legal activities. Claims and legal actions against the settler do not impact the trust or its beneficiaries as long as no fraudulent conveyance is involved in its formation and the client acts while there are no legal storms brewing on the horizon.

A WPT is a “Grantor Trust” that permits you and any other parties you choose to be its beneficiaries. As an irrevocable trust whose assets cannot be demanded by a beneficiary, attached or garnished by a beneficiary’s creditors, this powerful tool can provide protection from creditors while still allowing the “founder” benefits and control of the LLLP assets. WPTs are appropriate for a wide range of people such as professionals, officers, directors, fiduciaries, real estate owners with exposure to legal liability, and business owners.

Only in Nevada does the law provide one major advantage that is so preferable that it is difficult to justify establishing Wealth Protection TrustsTM in any other state. This advantage lies in a shorter time period under Nevada law between the date an asset is transferred and the date the asset is protected from the creditors of the founder.

USing A FAMILY LIVING TRUST TO AVOID PROBATE COURT

Once the Court gets involved it stays involved. The Court Judge, not your family, controls how your assets are to be used. Probate is expensive and publicly embarrassing for your family. Probate can last over a year before all the property is distributed, and incur substantial court and attorney costs for your family.

Property held in a Living Trust avoids probate. Your personal representative provides documentation to the court, and your estate is prevented from ever entering probate. One of the many ways to avoid probate is to execute a Living Trust.

As creator of a trust, you transfer ownership of your real property from yourself to a trust- which you control and can revise at any time. Upon death, the persons you named as beneficiaries in the trust acquire full ownership of the property of the trust. A Living Trust helps your estate avoid estate tax. And unlike probate (which is a fully public process), a Living Trust shields your private affairs and that of your heirs from public scrutiny.

A family living trust is a necessary component in family and estate planning:

|

JUDGMENT-PROOF YOUR ASSETS

By forming an Offshore International Business Company (IBC) you create a legal entity to hold assets, do business, and shelter the identities of the beneficial owners. No investigative agencies, trial lawyers, ex-spouses, ex-business partners, creditors, or anyone else attempting to locate your wealth will be able to find your sheltered accounts and assets. This makes you a very poor prospect for a lawsuit.

Case of the A&W Restaurant

A mother and son team owned a small-town A&W Restaurant and a small shopping complex employing approximately

30 full and part-time employees. One of the restaurant's junior-managers unexpectedly sexually harassed two

female employees and was subsequently fired. However, the fired junior manager soon returned by filing a

wrongful dismissal lawsuit and claiming no such abuse took place

The two female employees, in turn, also engaged attorneys and sued the owners of the A&W for $3 million and

$4 million dollars respectively, claiming sexual discrimination, emotional distress, physical harm, and alleging

a "pervasive" atmosphere of sexual harassment that led to on-site sexual incidents.

The owners now faced multiple lawsuits and felt sure that any decisions would rule in favor of at least one

employee. Their greatest fear was a class-action lawsuit plaintiffs' attorneys were surely considering.

Thankfully, these owners had already established their asset protection. The shopping mall was previously placed

into an LLC with multiple partner-owners to create charging order protection. The restaurant was previously

placed into a Nevada Corporation. Under new Nevada State laws all stock in the corporation is also protected by

charging order protections (available only to Nevada Corporations and not to the corporations of any other

state.) Finally, there were no other significant assets in the Nevada corporation.

At a meeting with the plaintiffs' attorneys, the owners pointed out there was no "pot of gold at the end of

the litigation rainbow". The clients had thought and planned ahead, and the plaintiffs' attorneys could not

assert any fraudulent transfer. The plaintiffs' attorneys did not want to go through a protracted and expensive

litigation challenging asset transfers. All suits were dropped and the owners cleared of any wrong-doing.

The fired junior-manager subsequently served a 20-month prison sentence on sexual misconduct charges relating to

the incidents.

STOP BEING A TARGET FOR

MONEY-HUNGRY LAWYERS

Tom Stanton thought he had it all - a beautiful home for his family, the car he had always wanted, a growing list of investments, his children in excellent schools, and dream vacations with his wife.

BUT that all changed when he was served with process naming him as a defendant in a huge lawsuit.

It did not matter that he was convinced he had done nothing wrong. He lost everything he had and still owes his attorney for all the legal costs.

WHY TAKE A CHANCE ON LOSING EVERYTHING

Contingency-fee cases and run-away jury awards have created a legal onslaught in the justice system. A growing number

of aggressive attorneys are now willing to pursue even marginal cases in the pursuit of massive awards.

Adding to this problem, and encouraging these lawsuits, is the fact that the cost of defending against even a

frivolous lawsuit often costs a minimum of $100,000 - even before the trial begins! Most defendants find it

necessary to surrender and "settle" rather than endure the prolonged emotional pain and financial

destruction of a full out battle. These "settlements" are often little more than formalized legal

extortion.

Listen below to John Ewing's exclusive call about the

Bridgeway Asset Protection Plan™:

WHAT IF YOU ARE FACED WITH A LAWSUIT

Do not be

fooled - even if you are innocent, that does not mean the courts are on your side. Jurors often side with the plaintiff

who appears to need the funds in question rather than the defendant who they assume has money to spare.

Do not be

fooled - even if you are innocent, that does not mean the courts are on your side. Jurors often side with the plaintiff

who appears to need the funds in question rather than the defendant who they assume has money to spare.

Even a judge's own personal feelings or politics can put you in jeopardy. Read the following outrageous quote below:

"As long as I am allowed to redistribute wealth from out-of-state companies to injured in-state

plaintiffs, I shall continue to do so. Not only is my sleep enhanced when I give someone else's money away,

but so is my job security, because in-state plaintiffs, their families, and their friends will re-elect

me."

- Chief Justice Richard Neely, West Virginia Supreme Court

If you act NOW it's not too late to shield your assets from plaintiffs and their attorneys. Clients are happy to

learn that there is still a lot they can do to protect their assets.

Judgment-proof Your Assets to Avoid Ruinous Lawsuits

By forming an offshore international business company, you create a legal entity to hold liquid assets. And no one knows who the owner is. All of the investigative agencies, which help trial lawyers, ex-spouses, ex-business partners, and creditors locate the wealth of the defendants they want to sue, will not be able to see or locate your offshore accounts. This makes you a poor prospect for a lawsuit.

YOU NEED ASSET PROTECTION

Without Asset Protection, You Could Lose Everything

- Nine out of ten lawsuits in the world are filed in the United States

- If you own a business or practice a profession, you have a one chance in three of being named a Defendant in a lawsuit in the next year, and it will only get worse. It is estimated that there are over 100,000 law school students in school right now.

Since a new lawsuit is filed every two seconds, the average business owner or professional person stands a chance of

being sued numerous times in his or her lifetime. Any lawsuit, no matter how apparently worthless, could result in a

ruinous judgment, or at a minimum disastrous legal fees.

Any of these events could leave you penniless and in debt:

- A negligence or injury claim, whether justified or not, that exceeds any insurance coverage you may have

- Breach of contract through no fault of your own

- A professional malpractice suit

- Lawsuits from disgruntled business partners or employees

- Loan guarantees

- Huge fines for violating state or federal law because of the actions of an employee

- Claims from creditors should your business fail

- Catastrophic medical bills

- Seizure of your home or other assets without due process by the U.S. Customs or other government agencies with forfeiture power - The Patriot Act

- A huge tax bill and escalating penalties following an IRS audit

YOU CAN BE COMPLETELY ANONYMOUS

In 1988 Bill Reed, Esq. former collections Attorney was having lunch with a federal judge. He noted to the judge that defendants with the largest assets often proved the hardest to collect from, and even when they lost everything, they frequently kept their cash and their lavish lifestyles. The judge countered Bill’s assessment saying, “Bill, if I can find an asset anywhere in my jurisdiction (the United States), I can seize that asset. Don’t ever forget that!”

> Click for a larger image

An important part of asset protection is privacy! At Bridgeway Financial Corporation we can provide full privacy for our clients.

NO EXCHANGE OF INFORMATION WITH IRS

Protecting a Medical Practice

A successful dentist owned his home, a diversified stock portfolio, his business practice, and an

income-producing office building. However, the dentist was concerned about his continued liability exposure in

the likely event of a malpractice lawsuit.

The doctor and his wife of thirty-five years reside in a 'Community Property' State. One of the worst aspects of

community property law is that any creditor of either of the spouses can collect against both the husband and

the wife, and against their community property.

What was done to protect them? First, the couple entered into a 'division of property assets' agreement. This

agreement between the doctor and his wife legally converted their community properties into separately owned

properties. It was important that the assets be divided such that a creditor could go after the doctor's assets

but have a difficult time going after the wife’s assets in the event either or both are sued. The doctor

retained only the assets a creditor would find useless, such as the assets of his medical practice.

For further protection, the dentist transferred the apartment building into a Nevada Limited Liability Company

(LLC), and the home was transferred to a Principal Residence Trust (PRT), and both were connected to a properly

set up Nevada Limited Liability Limited Partnership (LLLP).

INSURANCE IS NOT ENOUGH

If you own a business or practice a profession you have a one-in-three chance of being named a defendant in a lawsuit in the next year, and the odds will only grow worse. It is estimated that over 100,000 law school students are currently approaching graduation.

In spite of all of the money you pay in insurance premiums, there is no traditional insurance that can relieve you from the fear and anxiety that arises when litigation looms its ugly head. Even when the odds are in your favor, the time and effort required to prepare a defense can be unbelievably disruptive to your everyday business.

PROTECT YOUR ASSETS NOW BEFORE A LAWSUIT HAPPENS

Protecting Her Home

The woman was 84, her husband was deceased. She had lived in her home for 30 years, and it was fully paid off.

With virtually no savings, she lived off her Social Security checks.

While driving to visit her granddaughter, she was involved in an automobile accident and was subsequently sued

and held responsible for the accident. The plaintiff and their attorney demanded damages $250,000 in excess of

her insurance coverage. It was obvious she could very much be in danger of losing her home - a devastating

possibility.

However, wisely she had previously transferred the ownership of her home out of her name and into a properly set

up Irrevocable Trust.

Upon doing an 'asset sweep' search, the plaintiff’s attorney suddenly ceased their efforts to pursue this client

in excess of her insurance coverage. Typically, a plaintiff and their attorney will often settle the case in

order to obtain the insurance monies rather than go through a prolonged trial that may take months or perhaps

years to settle and achieve nothing.

It is important to note that you do not need to be rich to engage in asset protection planning. All assets are

worth protecting.

Whether you own a home with equity of $75,000 to $1,000,000 (or more) the need to protect your assets is the

same. A simple settlement leading any plaintiff to your insurance company relieves you of the costs and stress

of dealing with a tragic situation.

U.S. COURTS ARE NOT RECOGNIZED OFFSHORE

This ability to protect your assets is the reason many doctors, business professionals, and owners of small businesses have discovered IBCs as an effective way to protect assets.

The main reason for setting up an IBC – International Business Company is to create an offshore haven to move liquid assets quickly out of the United States. It is a known fact that judges, IRS and government agencies have frozen cash accounts in a move to cripple their opponent…that’s you. As part of “bullet proof” asset protection one should create a reserve account which we recommend in the Cayman Islands with at least a minimum balance of funds. If a client needs to move liquid assets quickly in light of pending litigation they can do so from their LLLP or LLC safely thereby avoiding the “fraudulent transfer rule” and avoiding any chance that a Judge can freeze all your cash assets.

Further, we recommend you “test

drive” your offshore account. You will find that the brokers are friendly, speak English and understand asset

protection…that’s part of their business. You will be amazed how easy it is to move money in and out of the U.S. and we

can take care of any tax filings if you earn income offshore. Air travel is quick, hotels are great and restaurants are

enjoyable as you go out and visit your money or you may never go…the choice is yours.

Further, we recommend you “test

drive” your offshore account. You will find that the brokers are friendly, speak English and understand asset

protection…that’s part of their business. You will be amazed how easy it is to move money in and out of the U.S. and we

can take care of any tax filings if you earn income offshore. Air travel is quick, hotels are great and restaurants are

enjoyable as you go out and visit your money or you may never go…the choice is yours. Once a lawsuit has been filed, the law will not allow you to move your assets. You must act ahead of time to protect what you own before it comes under attack.

Asset Protection from Lawsuits, Wealth Preservation, Debt Elimination, Business Entity Formation, Financial Strategy Consulting, Tax Reduction Consulting are based on sound principles of law, prudent forward planning, and compliance with the Internal Revenue Code. Tax evasion is illegal. Per IRS Circular 230, nothing herein may be used by any taxpayer to avoid penalties under the Internal Revenue Code for noncompliance or to support the promotion of any particular federal tax transaction. Taxpayers should confer with a Certified Public Accountant as to federal tax matters and timely file any applicable IRS forms or tax returns.

Not an offer of securities. Not intended as individual legal, tax or financial advice.

DISCLAIMER: All information contained in this website is for education purposes only. Bridgeway Financial Corporation™, and its agents and affiliates, cannot and will not render any legal, investment, financial or tax advice of any kind, unless said agent or affiliate is duly licensed by the applicable state and/or federal authority to give said advice.

Bridgeway Financial Corporation is not a broker or agent for any particular investment, but we share information with our clients about changing market conditions and attractive investment opportunities as we become aware of them.