WANT TAX FREE INVESTMENTS

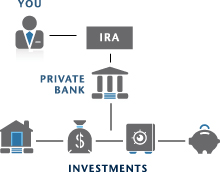

Combining your investment strategies with the use of an IRA Limited Liability Company (LLC) can be an incredible investment pairing. Through the utilization of the IRA's tax-deferred qualities, investment earnings are able to grow at a much faster rate than earnings created without this tax-deferred status.

Working with special assets can enable a knowledgeable investor to profit from their better understanding of the investment and its potential. Why pay someone else to manage your retirement when you are capable of acquiring substantial retirement savings by investing in what you know and understand?

When you combine the magic of compound interest with tax free investments, you can powerfully accelerate the rapid growth of money by investing with pre-tax dollars, instead of using after tax dollars.

WANT ASSET PROTECTION: CONSIDER OFFSHORE INVESTING

"The secret to success is to own nothing, but control everything." - Nelson Rockefeller

Offshore banking has increased rapidly around the world since the mid-1960's because of the growth and liquidity of world financial markets. The full spectrum of financial services from offshore banks include deposit taking, money transmission, provision of foreign exchange, trade finance, credit facilities, investment custody, investment management, fund management, trustee services, and corporate administration.

Offshore banks provide access to politically and economically stable offshore jurisdictions that may be of advantage for those living in areas where there is a risk of expropriation or where there is instability or corruption within the banking system. Many offshore banks offer services that may be unavailable in one's country of residence. The British Virgin and Cayman Islands, to name a few, prohibit the disclosure to any third-party of information pertaining to a client's affairs without the client's explicit written permission under penalty of law. Some offshore banks may even provide higher interest rates than banks in the home country.

The majority of offshore banks operate within highly regulated environments under national monetary bodies such as Central Banks, Financial Services Commissions, etc. These banks are required to maintain capital adequacy requirements in accordance with international standards, and they must submit financial reports at least quarterly to the regulator on the current state of their business.

One common misconception about offshore banking and offshore accounts is that they can legally prevent assets from being subject to personal income tax or interest. This conception is usually not applicable because the personal income tax statutes of most countries makes no distinction between interest earned in local banks and those earned abroad. For instance, people subject to US income tax are required to declare any offshore bank earnings they may have.

An offshore bank account will allow you to safely and privately explore, with few restrictions, the far reaches of the vast and diverse financial universe; from the bond markets of Korea to the stock exchanges of Eastern Europe; from the ultra-private Liechtenstein trust arrangements to the most successful funds; from unique commodity investments to Caribbean corporations; from Israeli nanotech start-ups to age-old European blue chips; from the mysterious and secretive world of offshore mutual funds to tax-free Swiss gold accounts; from Isle of Man insurance contracts to Danish multi-currency investment accounts; from uniquely structured tax-free Austrian funds to Bulgarian mortgages; and much more beyond.

Stock Alert Service

WANT TAX-FREE INVESTING: SELF-DIRECTED IRA

A carefully designed corporate strategy allows you to legally reduce your tax burden while also avoiding legal and taxation problems. Because a corporation has a life of its own, it allows you to care for your loved ones free from probate court and its associated legal and tax costs and problems.

By using a corporate LLC as the "sole private manager" of your retirement account, your funds are extensively protected as your earnings grow. Self-directed IRA accounts are federally insured, and you can further protect your investment dollars in a tax-sheltered

By using a corporate LLC as the "sole private manager" of your retirement account, your funds are extensively protected as your earnings grow. Self-directed IRA accounts are federally insured, and you can further protect your investment dollars in a tax-sheltered

asset protection Limited Liability Company. Imagine the power of 'owning nothing, but controlling everything!'

Simply put...you keep more of what you earn!

TWO INVESTMENT WORLDS: WALL STREET VS. YOU

There exists two investment worlds in America: one for Wall Street bankers and one for ordinary citizens. The first investment world consists of premium investment opportunities of the most lucrative profitability reserved, by law, for only the most well-connected or wealthiest investors. The second world consists of the remaining lessor opportunities available to ordinary citizens, usually returning marginal returns of 5% or less a year, including stocks, bonds, CD's, etc. Most common investors have never heard of this 'first-tier' investment world, but they've seen the outlandish billion-dollar bank profits and bonuses and wondered "How is this even possible?" Clients of Bridgeway Financial know, and more importantly can gain access to this secretive investment world.

There exists two investment worlds in America: one for Wall Street bankers and one for ordinary citizens. The first investment world consists of premium investment opportunities of the most lucrative profitability reserved, by law, for only the most well-connected or wealthiest investors. The second world consists of the remaining lessor opportunities available to ordinary citizens, usually returning marginal returns of 5% or less a year, including stocks, bonds, CD's, etc. Most common investors have never heard of this 'first-tier' investment world, but they've seen the outlandish billion-dollar bank profits and bonuses and wondered "How is this even possible?" Clients of Bridgeway Financial know, and more importantly can gain access to this secretive investment world.